Roth 401k Catch Up 2024

Roth 401k Catch Up 2024. Up to contribution limits — $23,000 in 2024, plus a. The limit for overall contributions—including the employer match—is 100%.

As an employee in 2024, you can contribute the lesser of $23,000 or 100% of compensation. In 2024, for example, workers 50 and older can make additional contributions of up to $8,000 to their 401(k) accounts.

The Irs Sets The Maximum That You And Your Employer Can Contribute To Your 401 (K) Each Year.

In 2024, you’re able to contribute.

May 10Th, 2023 | Ed Slott’s Ira Corner.

They can also contribute up to $1,000 extra to a.

Currently And As Noted, Retirement Plan Participants 50 And Older Can Contribute An Additional $7,500 To Their Retirement.

Images References :

Source: ardythqhermione.pages.dev

Source: ardythqhermione.pages.dev

Roth Contribution Limits 2024 Minda Lianna, Currently and as noted, retirement plan participants 50 and older can contribute an additional $7,500 to their retirement. The limit for overall contributions—including the employer match—is 100%.

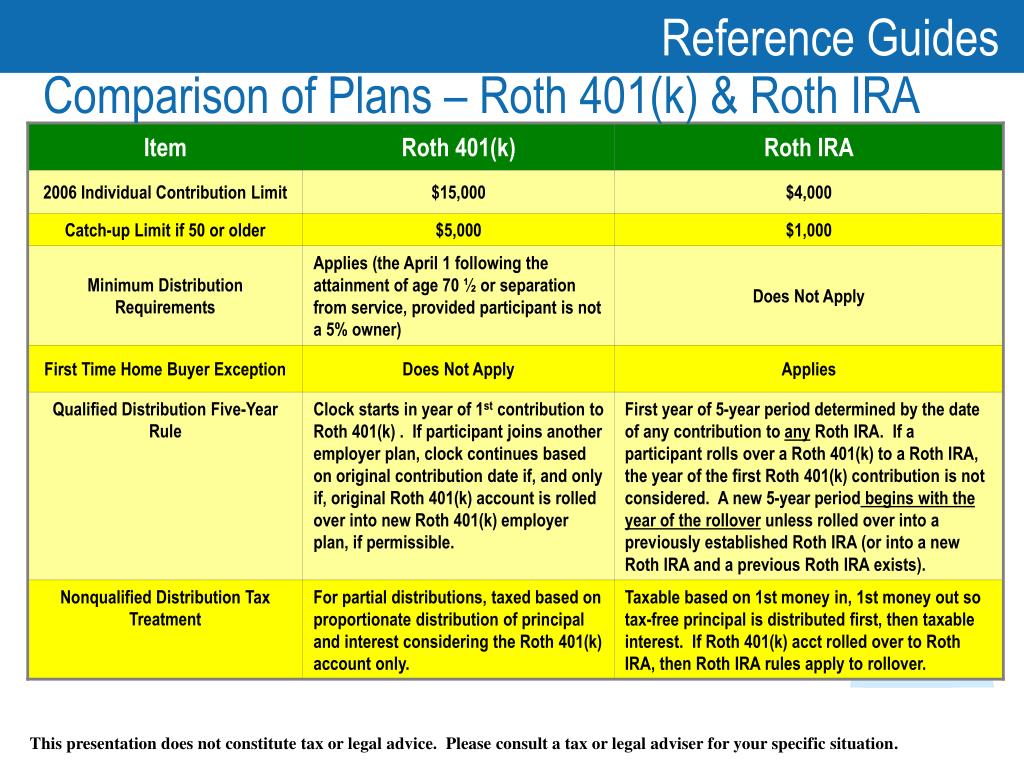

Source: www.slideserve.com

Source: www.slideserve.com

PPT Understanding the New Roth 401(k) PowerPoint Presentation, free, In 2024, you’re able to contribute. The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics Why Choosing a Roth Solo 401 k Plan Makes Sense?, From 2024 onward, if you're an employee with a 401 (k), 403 (b), or a government 457 (b) retirement plan and earned more than $145,000 the previous year,. The net result is that in 2023, a.

:max_bytes(150000):strip_icc()/Roth-401K-Final-1ed01a8c82d14465846c533ab2e0eed2.jpg) Source: www.investopedia.com

Source: www.investopedia.com

What Is a Roth 401(k)?, The net result is that in 2023, a. You can easily unsubscribe at any time.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

The Ultimate Roth 401(k) Guide District Capital Management, Roth iras are also accessible for most people, as you can open an account at many banks, credit unions and brokerages. The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Understanding the New Roth 401(k) PowerPoint Presentation ID510897, One of the more controversial provisions of the new secure 2.0. A simple ira or a simple 401 (k) plan may permit.

Source: www.greenbushfinancial.com

Source: www.greenbushfinancial.com

Should You Make Pretax or Roth 401(k) Contributions? Greenbush, In 2024, you’re able to contribute. A simple ira or a simple 401 (k) plan may permit.

Source: tramitesusaypuertorico.com

Source: tramitesusaypuertorico.com

Roth 401k vs 401k regular ᐈ GUÍA COMPLETA【2024, In 2024, for example, workers 50 and older can make additional contributions of up to $8,000 to their 401(k) accounts. However, in august 2023, the irs.

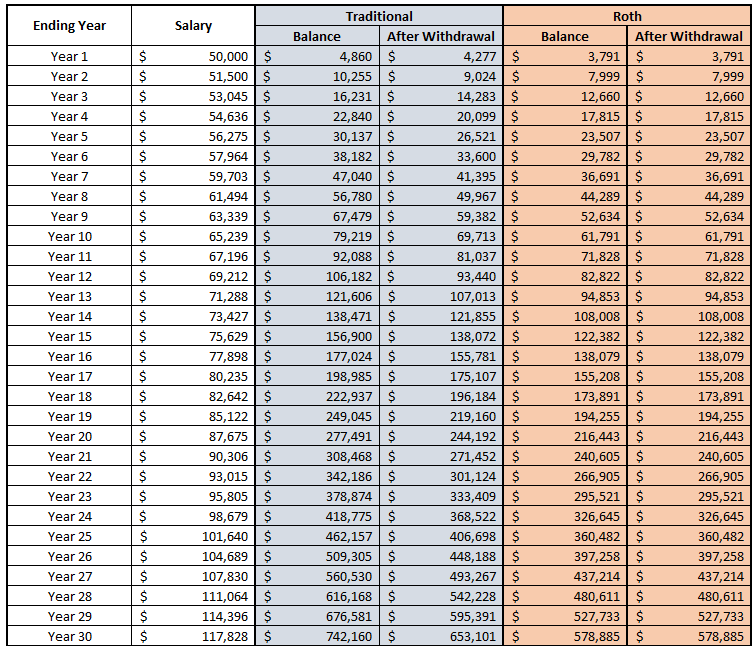

Source: einvestingforbeginners.com

Source: einvestingforbeginners.com

Optimize Your Retirement With This Roth vs. Traditional 401k Calculator!, The roth ira contribution limit for 2024 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older. This means you will not get the tax benefit.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021, The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. If the balance in your ira at the end of 2023 was $150,000, you’d need to divide $150,000 by 24.6 years.

For 2024, The Maximum You Can Contribute From Your Paycheck To A 401 (K) Is $23,000.

For the 2023 and 2024 tax years, anyone 50 and older can contribute up to $7,500 in additional funds to their 401(k).

One Of The More Controversial Provisions Of The New Secure 2.0.

Last updated 28 august 2023.